Benefits

Your Medical Benefits

Eligibility:

Full time faculty, staff, and facilitators with a current academic year contract.

Dependents who are eligible for benefits are as follows:

– spouse

– children or legal guardianship dependents up to the age of 26 regardless of student or marital status

Waiting Period:

First of the month following or coincidental with date of hire

Your Dental Benefits

Contribution Schedule

| BCBS Plan | |

|---|---|

| Employee only | $11.32 |

| Employee + 1 | $25.45 |

| Employee + family | $44.42 |

Helpful Resources

Your Vision Benefits

Eligibility:

Full time faculty, staff, and facilitators with a current academic year contract.

Dependents who are eligible for benefits are as follows:

– spouse

– children or legal guardianship dependents up to the age of 26 regardless of student or marital status

Waiting Period:

First of the month following or coincidental with date of hire

Contribution Schedule

| Employee only | $3.57 |

|---|---|

| Employee + 1 | $5.18 |

| Employee + family | $9.29 |

Helpful Resources

www.vsp.com – to find a doctor, check benefit information and more

Your Employer Paid Life Insurance

Bethel University provides both Life and Accidental Death and Dismemberment insurance at no cost to you. This coverage is provided through USAble Life. The amount of the benefit is $50,000.

Life insurance provides financial security for the people who depend on you. Your beneficiaries will receive a lump sum payment if you die while employed by Bethel University.

Eligibility:

Full time Faculty & Staff (excluding Facilitators)

Waiting Period:

First of the month following or coincidental with date of hire

Benefit Forms

Contribution Schedule

Group Life is 100% paid for by the company.

Helpful Resources

USAble Life Contact

1-800-370-5856

To submit a claim or change your beneficiary, Contact Karen Phelps

Phone: 731-352-4063

Fax: 731-352-4017

Email: phelpsk@bethelu.edu

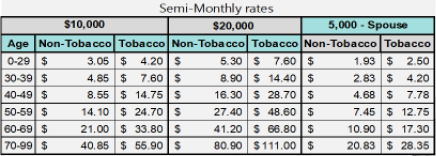

Your Voluntary Life Benefits

Bethel University offers participation in a voluntary term life insurance program. The coverage is provided by USAble Life. Employees can elect coverage in increments of $10,000 up to a maximum of $150,000.

Eligibility:

Full time Faculty & Staff (excluding Facilitators)

Waiting Period:

First of the month following or coincidental with date of hire

Contribution Schedule

| Voluntary Employee Life Insurance | |

|---|---|

| Employee Age Band | Employee Rate per $10,000 Per Pay Period |

| 0-29 | $0.40 |

| 30-34 | $0.45 |

| 35-39 | $0.60 |

| 40-44 | $0.95 |

| 45-49 | $1.65 |

| 50-54 | $2.45 |

| 55-59 | $3.70 |

| 60-64 | $6.05 |

| 65-69 | $10.95 |

| 70-74 | $15.50 |

| 75-79 | $33.45 |

Example: Coverage Amount/10,000 x rate = premium (per pay period)

| Voluntary Spouse Life Insurance | |

|---|---|

| Employee Age Band | Employee Rate per $5,000 Per Pay Period |

| 0-29 | $0.20 |

| 30-34 | $0.23 |

| 35-39 | $0.30 |

| 40-44 | $0.48 |

| 45-49 | $0.83 |

| 50-54 | $1.23 |

| 55-59 | $1.85 |

| 60-64 | $3.03 |

| 65-69 | $5.48 |

Helpful Resources

USAble Life Contact

1-800-370-5856

To submit a claim or change your beneficiary, Contact Marissa Griggs:

Phone: 731-352-6958

Fax : 731-352-4017

email: griggsm@bethelu.edu

Your Short Term Disability Benefits

Short-term Disability is provided by Bethel University

All regular full‐time employees of Bethel University are eligible for short‐term disability through the Salary Continuance Benefit after

completing six months of service.

Prior to receiving payments from the Short‐Term disability plan, all available sick, personal or vacation days must first be exhausted.

Contribution Requirements

The cost of the Short‐Term Disability plan is paid 100 % by Bethel University.

Elimination Period

Benefits begin after 14 consecutive days of disability.

Maximum Duration of Benefits

Benefits, for one period of disability, will be paid up to a maximum of 180 days.

Semi‐Monthly Benefit Amount

The semi‐monthly benefit is an amount equal to 50% of covered semi‐monthly earnings.

Contribution Schedule

Short Term Disability is 100% paid for by the company.

Helpful Resources

To submit a claim, Contact Marissa Griggs:

Phone: 731-352-6958

Fax : 731-352-4017

email: griggsm@bethelu.edu

Your Long Term Disability Benefits

Prior to receiving payments from the disability plan, all available sick, personal or vacation days must first be exhausted.

Contribution Requirements

The cost of the Long‐Term Disability is paid 100% by Bethel University.

Elimination Period

Benefits will begin after 180 consecutive days of Total Disability.

Maximum Duration of Benefits

To Social Security Normal Retirement Age.

Monthly Disability Benefit Amount

The monthly benefit is an amount equal to 60% of covered monthly earnings up to a maximum benefit of $10,000.

Exclusions and Limitations

- 24 Month Mental & Nervous Limitation

- 24 Month Drug & Alcohol Limitation

- Pre‐Existing Limitation ‐

For a condition that exists in the three months prior to the effective date of coverage, benefits will not be paid in the first 12 months of

coverage.For a comprehensive list of exclusions and limitations, please refer to the Certificate of Insurance. The Certificate also provides all requirements necessary to

receive a benefit.

Helpful Resources

To submit a claim, Contact Marissa Griggs:

Phone: 731-352-6958

Fax : 731-352-4017

email: griggsm@bethelu.edu

USAble Customer Service

1-800-370-5856

Your Accident Benefits

Even with good insurance, injuries can set your finances back in a big way. And when you’re hurt, the last thing you want to worry about is out-of-pocket expenses you’re not prepared to pay.

Accident Insurance can help, by paying benefits directly to you if you get treatment for a covered accident. That way, your injury doesn’t have to derail your financial security.

Your Unum Critical Illness Benefits

When a serious illness strikes, your finances can be endangered, along with your health. Even if you have health insurance, the out-of-pocket costs of treatment, hospitalization and missing work can add up fast.

Critical Illness Insurance can help you weather a crisis without draining your savings. If you’re diagnosed with a covered illness like cancer, stroke, heart attack or other condition, your plan can pay a lump-sum benefit directly to you, to use however you choose.

Your Unum Hospital Indemnity Benefits

Your 401k Benefits

Plan Highlights

Eligibility

You are eligible to participate when you have attained age 18.

The plan does not allow participation by employees who are leased employees, non-resident aliens with no U.S. earned income, union employees or reclassified employees, part-time, temporary or seasonal employees whose regularly scheduled service is less than 1,000 hours of service, or students.

Other requirements may have to be met, as described in the Summary Plan Description

Plan Entry

Eligible employees may join the plan on their date of hire.

Contribution Limits

Through automatic payroll deductions, you may contribute from 1% to 100% of your pay in pre-tax contributions. An annually adjusted Internal Revenue Service (IRS) dollars limit also applies. The dollar limit is $19,000 for 2020. If you are 50 or older this year, you may contribute an additional $7,000 for a maximum of $26,000 for 2020. Your contributions may be limited below this amount by other legal limits in certain cases.

Convenient Asset Consolidation

To simplify your financial life, the plan allows for rollovers from other retirement accounts you may have such as 401(k)s, 403(b)s, Governmental 457(b) plans and some IRAs. Complete the rollover form located in this booklet if you wold like to roll assets into your account. You may also call 800-228-8076 to request a rollover form.

Changing Contributions

You may stop your contributions anytime. You may also increase or decrease how much you contribute to the plan anytime. Log on to BBT.com/MyRetirementPlan or call 800-228-8076 to make changes to your contributions.

Employer Contributions

The plan provides for discretionary matching contributions on your contributions in an amount to be determined by your employer. The employer match also applies to any catch-up contributions you are allowed to make to the plan, subject to the same terms and conditions.

Your Summary Plan Description provides more information describing how these employer contributions as computed.

Vesting

Vesting refers to “ownership” or the portion of your account that belongs to you. You are always 100% vested in your own contributions and your rollover contributions, plus any related earnings.

Employer contributions to the plan, plus any related earnings, are currently vested as follows.

| Years of Vesting Service | Vesting Percentage |

|---|---|

| Less than 3 | 0% |

| 3 or more | 100% |

Plan Investments

You give investment direction for your plan account by selecting from the plan’s investment options. You may change how your future contributions are invested anytime. More information about the plan’s investment choices can be found elsewhere in these materials.

If you do not make an investment election, your plan contributions will be invested in one of the target date funds listed below most applicable to the date you are expected to retire.

| Investment Option Name | From Date | To Date |

|---|---|---|

| T. Rowe Price Retirement 2010 Fund | 01/01/2000 | 12/31/2014 |

| T. Rowe Price Retirement 2015 Fund | 01/01/2015 | 12/31/2019 |

| T. Rowe Price Retirement 2020 Fund | 01/01/2020 | 12/31/2024 |

| T. Rowe Price Retirement 2025 Fund | 01/01/2025 | 12/31/2029 |

| T. Rowe Price Retirement 2030 Fund | 01/01/2030 | 12/31/2034 |

| T. Rowe Price Retirement 2035 Fund | 01/01/2035 | 12/31/2039 |

| T. Rowe Price Retirement 2040 Fund | 01/01/2040 | 12/31/2044 |

| T. Rowe Price Retirement 2045 Fund | 01/01/2045 | 12/31/2049 |

| T. Rowe Price Retirement 2050 Fund | 01/01/2050 | 12/31/2054 |

| T. Rowe Price Retirement 2055 Fund | 01/01/2055 | 12/31/2059 |

| T. Rowe Price Retirement 2060 Fund | 01/01/2060 | 12/31/2070 |

If your date of birth is not on file, the investment selection will be made by your plan administrator.

ProNvest

The plan offers ProNvest, an independent retirement planning firm, to assist you in planning and managing your retirement plan assets. You can hire ProNvest to actively manage your account. ProNvest will use the investments available in the plan to implement ongoing investment advice, rebalance your account and make adjustments to become more conservative as you near retirement. You may have access to ProNvest once you are a participant in the plan by logging on to BBT.com/MyRetirementPlan and selecting the Investment Advice tab. ProNvest will deduct a 1.00% annual fee on a quarterly basis, if you hire ProNvest to actively manage your account. Additional details about ProNvest are provided in this guide.

Withdrawals and Distributions

Withdrawals from the Bethel University 401(k) Plan are generally allowed when you terminate employment, retire, reach age 59 1/2, have become permanently disabled or have a severe financial hardship as defined by the plan. Keep in mind that withdrawals are subject to income taxes and possibly early withdrawal penalties.

While you are employed at Bethel University, you may withdraw money from any rollover contributions.

In addition, the proceeds from your retirement plan account will go to your beneficiaries in the event of your death. Be sure to complete a beneficiary designation to select your beneficiaries.

It is important to talk to your tax advisor before withdrawing any money from your plan account.

Statements

A personalized summary plan statement is provided quarterly to help you monitor activity in your account.

24/7 Access

You have access to online retirement plan information before you log on to your account, including over 20 different tools and calculators. You may also log on to your account to find out information about your retirement plan features and investments. Go to BBT.com/MyRetirementPlan for more information or call 800-228-8076. Press “0” to speak to a representative Monday-Friday between 8 AM – 8 PM ET.

Additional Plan Information

Enrollment material and other important plan information are available at http://www.sponsorportal.com/bbtebn?plan=901027

Summary Plan Description

The above plan highlights provide only a brief overview of the plan’s features and is not a legally binding document. A more detailed Summary Plan Description will be given to you. Additionally, your employer may amend the plan at any time to change its terms. If there is a disagreement between this document and the plan, the plan’s terms govern. Please read it carefully and contact your plan administrator if you have any further questions.